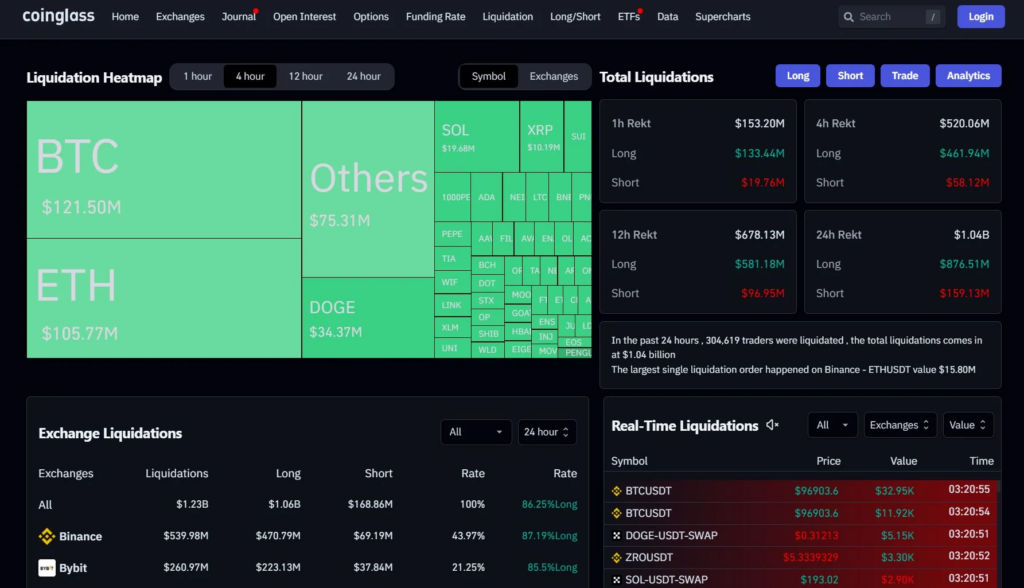

The crypto market has taken a heavy hit, with leveraged liquidations amounting to $1 billion following a sharp drop in Bitcoin (BTC) that brought the price below $96,000 on Thursday, according to data from Coinglass.

Long positions suffered the most loss, accounting for about $878 million, while short positions were responsible for $160 million in losses.

The drop was not limited to Bitcoin; most other crypto assets also fell in value. The total market capitalization of cryptocurrencies dropped by 9.5% to $3.4 trillion. Ether (ETH) lost 8%, Ripple (XRP) saw a drop of 5%, while Solana (SOL) and Dogecoin (DOGE) lost double digits in value. Small-cap crypto assets were particularly hard hit, with the exception of Movement (MOVE), which managed to limit its losses.

The markets reacted to what appeared to be an unexpectedly hawkish stance from the Federal Reserve after a 25 basis point rate cut on Wednesday. The Fed indicated that fewer rate cuts are to be expected in 2025 due to economic uncertainties, especially with the incoming administration. Fed Chairman Jerome Powell emphasized the need for a cautious approach given the unclear economic outlook.

While inflation has cooled from the peak of 9% in June 2022, it remains above the Fed’s target of 2%. Rate cuts can stimulate the economy by making borrowing cheaper, but also carry the risk of higher inflation. There are concerns that Donald Trump’s economic policy proposals, such as tariffs, could further drive up inflation, despite the short-term benefits for economic growth.

In the Bitcoin ETF market, there are signs of a changing sentiment. Although US spot Bitcoin ETFs have maintained a positive inflow streak of 14 days, the net inflows are mainly concentrated at BlackRock’s IBIT. Other ETFs reported zero or even net outflows. On Thursday, Grayscale’s low-cost Bitcoin ETF lost about $188 million, the lowest level since its launch, while Grayscale’s Bitcoin Trust saw a net outflow of about $88 million.

Despite the sell-off, Bitcoin has seen an impressive rise of 130% this year. MicroStrategy, which owns nearly 2% of all Bitcoins, continues its aggressive buying strategy with a $3 billion investment this month. Many traders see the recent dip as a healthy correction within a bull market. Titan of Crypto stated the following on X:

“It remains the same story every time; markets are not designed to let the majority win. Corrections are a natural part of bull markets.”

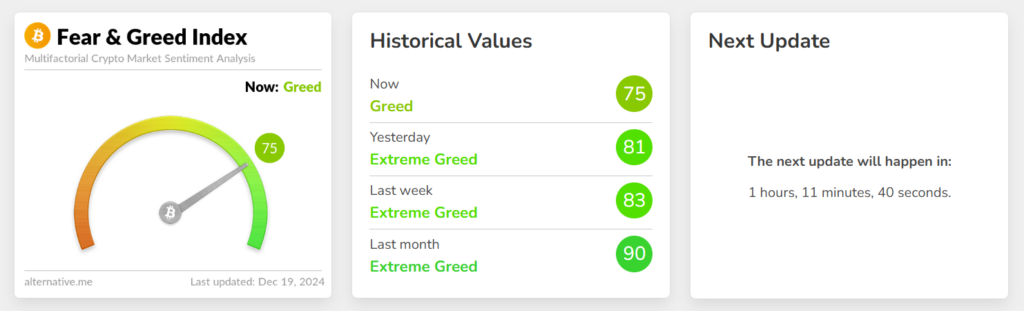

The Crypto Fear and Greed Index, which measures the emotional state of the market, stands at 75, indicating a sentiment of greed, despite the recent volatility and price corrections.