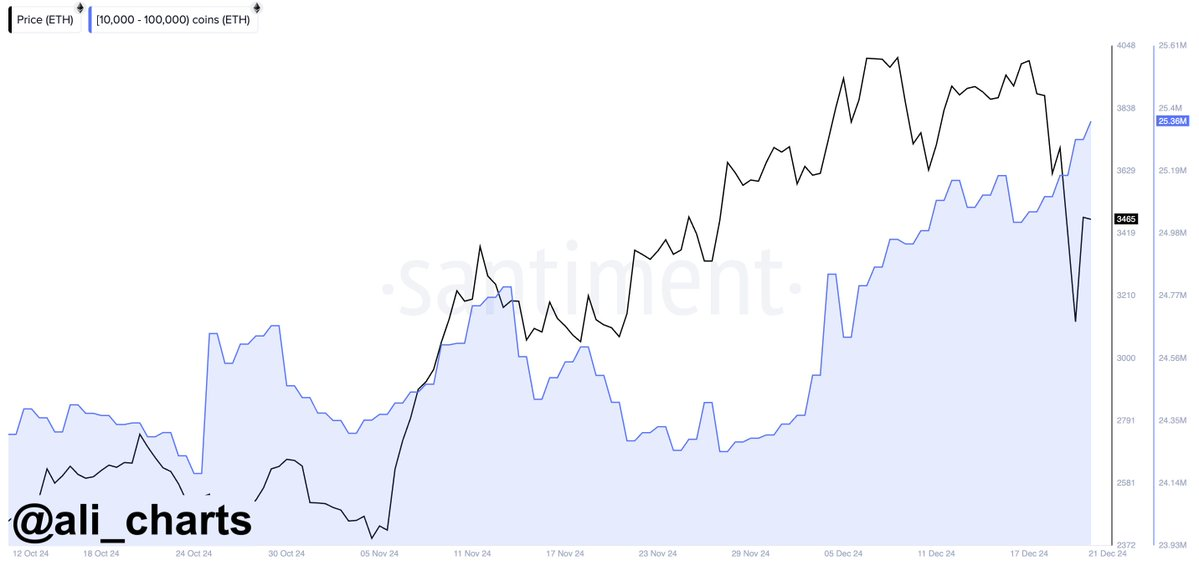

The activity of Ethereum (ETH) whales has shown an interesting dynamic in contrast to price movements, indicating strategic purchases during market downturns. Over three days, whales have amassed as much as 340,000 ETH, with a total value of over $1 billion. This behavior of bulk buying during price drops suggests confidence in an imminent rise in the Ethereum price.

These purchases come during a period of broader market downturns, which has sparked speculation about a possible imminent market recovery. This pattern is not uncommon, as historical data often show that significant accumulation by whales precedes a price recovery. This could mean that ETH could see a price increase in the short term, provided this trend continues.

The weekly chart of Ethereum, published by Washigorira on X, suggests that the recent correction may be over. The Ethereum price successively tested the Tenkan and Kijun lines of the Ichimoku Kinko Hyo indicator, indicating stabilization. Further indications of support became visible when ETH hit the Senkou Span A of the Kumo Cloud, which functioned as resistance but may now offer support.

In addition, the lagging span returned to its Tenkan line, reinforcing the stability of the current price levels. Although these signals are bullish, caution remains, with the possibility of a retest of the Senkou Span B of the Kumo Cloud, which would be a critical test of market sentiment.

The Long Term Trend Directions (LTTD) score for the year could end at a strong bullish level of 0.82, suggesting a positive long-term outlook. Despite a dip mid-year, the LTTD score has recovered to bullish territory, indicating continued interest from buyers. The drop in July coincided with a price drop, indicating a brief bearish phase, but the quick recovery action in October and the associated price increase suggest that the correction phase is over and ETH is resuming its long-term upward trend.

However, there was a notable outflow at Ethereum ETFs, with BlackRock’s ETHA seeing the largest outflow ever, about $103.7 million, during a week of market downturns. Bitcoin ETFs also saw their largest outflow since inception, with a total of about $671.9 million. This marked the end of two consecutive weeks of inflow for both Bitcoin and Ethereum ETFs.

Notably, despite the outflow, BlackRock has built substantial positions, with 13.7K BTC worth $1.45 billion and 33.9K ETH worth $143.7 million. These movements reflect broader market sentiments and could set the stage for future trends in cryptocurrency investments.