Shortly after the economic crisis of 2008, a document known as a whitepaper appeared on the internet in which a certain Satoshi Nakamoto described a new kind of payment system. It could become one of the most groundbreaking inventions of the 21st century. Unlike the current financial system, this system functions entirely in a decentralized manner, is not governed by anyone, and is completely open and available for everyone to read.

No one can claim ownership of it because there is no company or governing body behind Bitcoin. The creator even disappeared a few months after the release of the whitepaper. He or she never revealed their identity and communicated only via mailing lists with other “cypherpunks,” another term for those interested in cryptography, game theory, and internet technology.

In this whitepaper, Satoshi describes how he can ensure that value can be transferred between two people over the internet through a system called blockchain. This value is expressed in Bitcoin. Each transaction, along with other transactions, is stored in a block and must be confirmed to be permanently recorded in the ledger of all transactions.

The various users in the network and the transactions they conduct with each other are secured using very strong cryptographic methods. Therefore, it is impossible to hack the blockchain itself. To provide this ironclad security, the computational power of computers is required—a lot of it. So much so that in some parts of the world, there are large farms where electricity is converted into Bitcoin instead of animals being fattened. These are the miners.

In exchange for the energy that miners convert into computing power to confirm or verify transaction blocks for the network, they receive a reward in Bitcoin. In the early years, there were no farms with massive special equipment. Back then, it was still possible to collect Bitcoin in your attic with your laptop because the network was small and the difficulty level was low. The rewards were also the highest. You may have heard stories about old laptops with a stash of Bitcoins whose passwords are forgotten.

The primary factor is its absolute and controlled scarcity, along with other properties that we won’t delve into in this article.

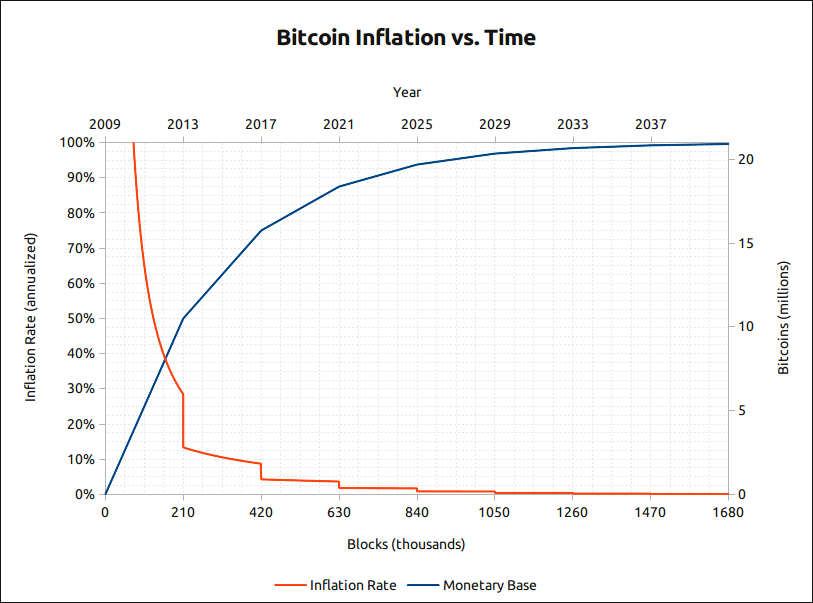

First, the Bitcoin source code specifies that there will never be more than 21 million Bitcoins available. This is a property that cannot be changed unless the entire network of users agrees. Currently, roughly 18.6 million Bitcoins have already been brought into circulation, which is almost 90%.

Second, the release of new Bitcoins is also fixed in the source code. Currently, there are 6.25 Bitcoins per verified block, and approximately one block is verified every 10 minutes. This totals an average of 900 Bitcoins per day.

Third, there is a mechanism linked to this reward called “halvings.” Every 210,000 blocks, the reward for the computing power is halved. For the first 210,000 blocks, the reward was 50 BTC per block, which dropped to 25 BTC on November 28, 2012, approximately four years later to 12.5 BTC, and in May 2020 to 6.25 BTC.

The fourth halving just happend and has lowered the blockrewards to 3.125 BTC per block. The final halving will not take place until around the year 2140. The reward miners receive by then will be only a fraction of what they earn today.

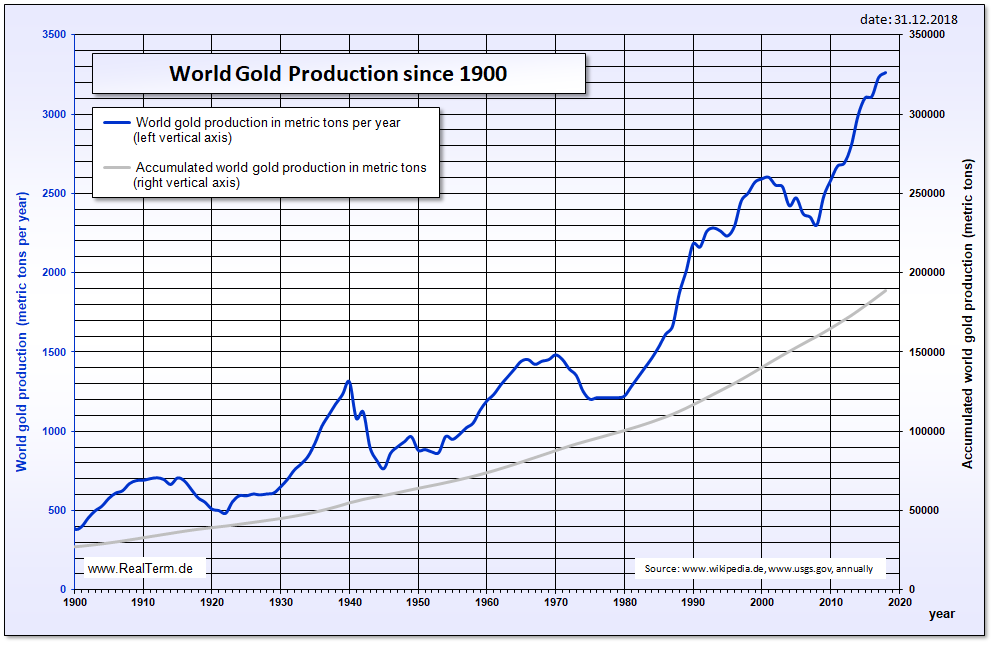

These three properties of Bitcoin contribute to an unprecedented level of scarcity, even when compared to gold. Gold has long served as both a medium of exchange and a way to preserve value over time. Think of gold jewelry passed down from generation to generation. Gold has been a good store of value because, over the years and centuries, there has always been someone willing to pay for your gold.

One of the key differences between gold and Bitcoin is scarcity. The chart below shows the annual global production of gold over the past 100 years, revealing a steady growth that confirms gold is not as scarce as some might think. In fact, no one knows for sure how much gold is yet to be discovered, as new gold veins are discovered every year.

In terms of scarcity, gold does not compare to Bitcoin, which, from the beginning, has been known for its total supply and rate of availability. This characteristic makes Bitcoin an investment vehicle whose future value is uncertain. Looking back at Bitcoin’s short, turbulent history, it appears to be an investment that has only risen in value over the long term.

Yes, there are significant price fluctuations, but they are mainly short-term. The increases always tend to outweigh the decreases. The chart below shows the price of Bitcoin over the past 11 years in black and white.

There are, of course, many more reasons to favor Bitcoin. We invite you to explore our website for more articles on this topic.