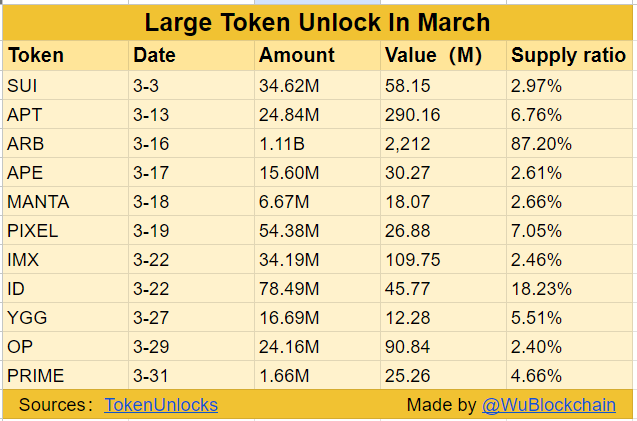

Although this month has already been a bumpy ride for crypto, March 2025 is set to be a wild month for the crypto market. According to Token Unlocks, more than 32 projects are ready to release tokens worth over $3 billion. The big player in this story? Arbitrum (ARB), which is set to send more than 1 billion tokens to the market by March 16 – a whopping 87% of the current circulating supply. What does this mean for ARB, other altcoins, and the market as a whole?

The ARB unlock is no small event – with a value of around $2.2 billion, this is shaking things up considerably. Of that pot, 673.5 million tokens are going to the core team and advisors, while investors are getting their hands on 438.25 million ARB. That’s a huge load of new tokens flowing into the market.

These kinds of unlocks often have a bearish effect, especially if buyers are not ready to absorb the extra supply. But who knows, perhaps whales see a buying opportunity here? However, if demand does not follow – and that’s a big ‘if’ – the price of ARB could come under serious pressure.

Arbitrum is not alone. Aptos (APT) is dropping 24.84 million tokens on March 13, about 6.76% of the circulating supply, worth $290 million. Sui (SUI) is releasing 34.62 million tokens on March 3, worth $58.15 million, and Optimism (OP) is closing the line with 24.16 million OP tokens worth $90 million for March 29. These projects have been pumping new tokens into the market all year, raising questions. How long can their prices hold up if the dilution continues? Especially Sui and Optimism need to show that they can boost demand to mitigate the impact.

March will be a test for the crypto market. Arbitrum’s billion-dollar drop could trigger a domino effect, especially if APT, SUI, and OP also come under pressure. However, volatility always offers opportunities – savvy traders can profit from dips if demand rebounds.