Solana (SOL) is currently at a critical juncture as it tests the support level of $153.95. Investors are closely monitoring the market to see whether this support holds after a 6% drop or if downward pressure will push Solana’s price even lower.

The stochastic RSI, an indicator of market trends, is shifting from an overbought zone to a neutral area. This suggests that Solana might be building upward momentum, which could lead to further price increases.

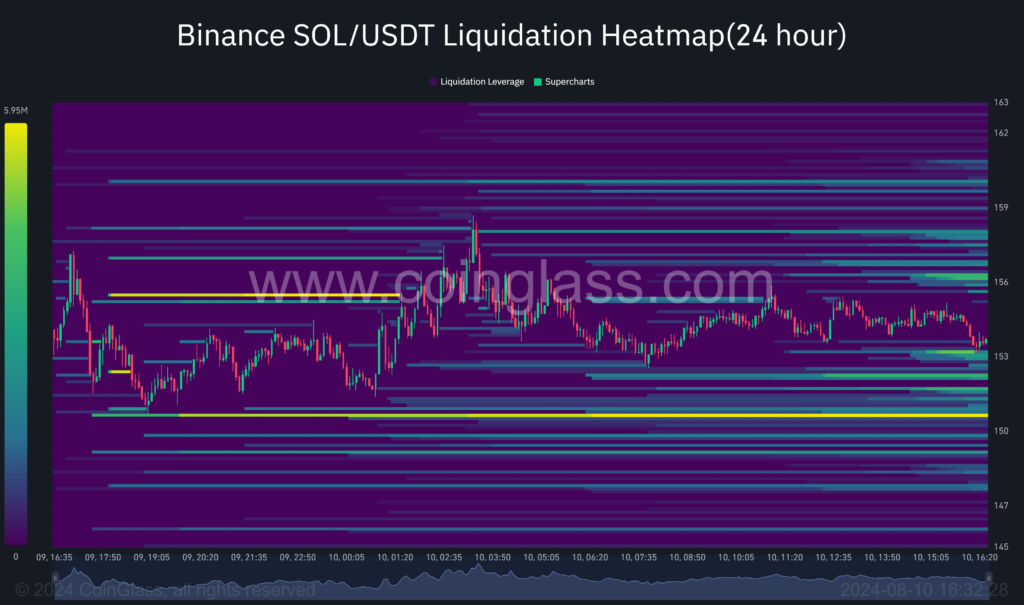

Data shows a significant liquidation pool for Solana, valued at approximately $5.96 million, just below the support level of $153.95, particularly around the $150 mark. This increases the likelihood that the $153.95 support might be breached. A liquidation pool of this size could trigger forced selling through activated stop orders, potentially driving Solana’s price even lower.

On the other hand, there are also liquidation pools above $153.95 that could serve as support, possibly triggering an upward movement if the bulls regain control.

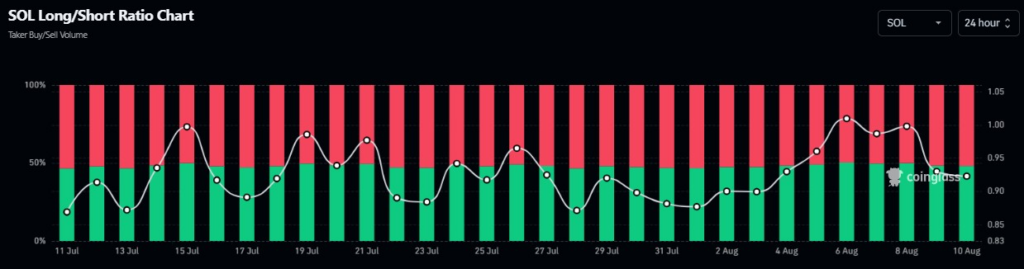

Although the ratio of short to long positions currently favors the bears, there are signs that the bulls are showing resilience. Despite a slight short-term decline, recent fluctuations indicate that the bulls are slowly gaining strength. If buyers can maintain this momentum, an upward reversal could occur.

This ongoing battle between bears and bulls may lead to a consolidation phase, where the price stabilizes before a clear direction is chosen. If the $153.95 support level breaks, the price may likely drop to around $150, where strong support lies. However, if the bulls manage to hold this support, it could trigger a mild increase, potentially retesting higher resistance levels.

The future direction of Solana will depend on how the liquidation pools and the ratio of long to short positions evolve, which will be crucial for the next major price movement.