Last week, Solana (SOL) experienced a significant price drop of 17.13%, as reported by CoinMarketCap. This drop followed a new record high of $263.83 after the US presidential elections in November. However, with the crypto market still in the early stages of a bullish cycle, Glassnode analysts remain optimistic about Solana’s recovery.

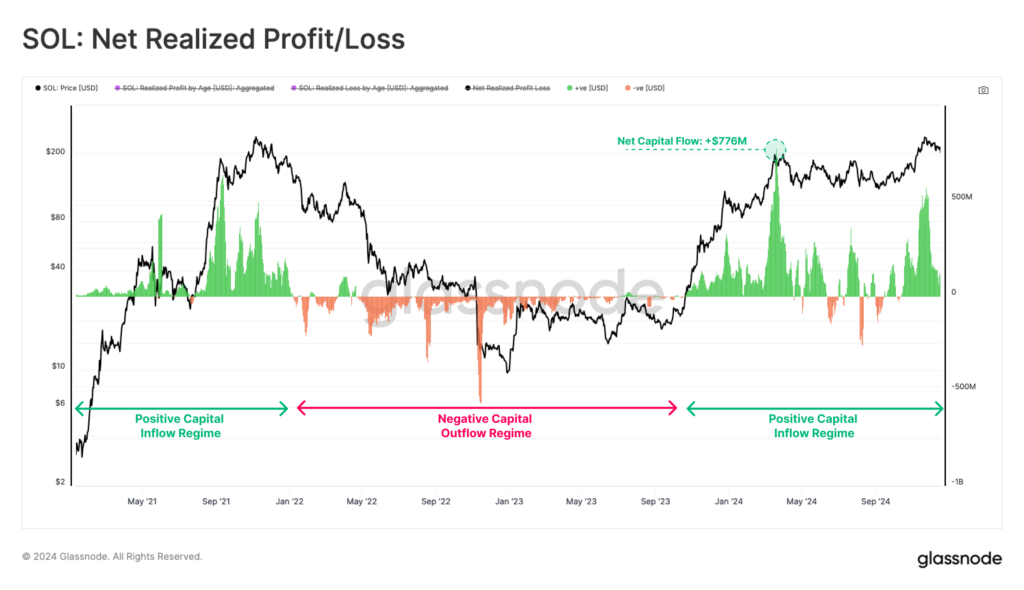

In a blog post dated December 20, in collaboration with crypto analysts UkuriaOC and CryptoVizArt, Glassnode provides insight into Solana’s current market situation. They analyzed the Net Realized Profit/Loss metric and found that Solana has had a positive capital inflow since September 2023, peaking at $776 million in new capital per day at certain times.

This inflow primarily comes from coins held by both short-term and long-term holders, underscoring Solana’s broad appeal.

Glassnode used the Market Value To Realized Value (MVRV) ratio to gauge the temperature of the market. This ratio, which indicates whether an asset is over- or undervalued, shows that Solana is currently moving sideways between the average MVRV and the +0.5 standard deviation, suggesting that the market is warm, but not yet at the top of a bull market.

Historically, a breakout above the +1 standard deviation means that Solana is at a macro top, implying there is still room for price increases before a possible overheating occurs.

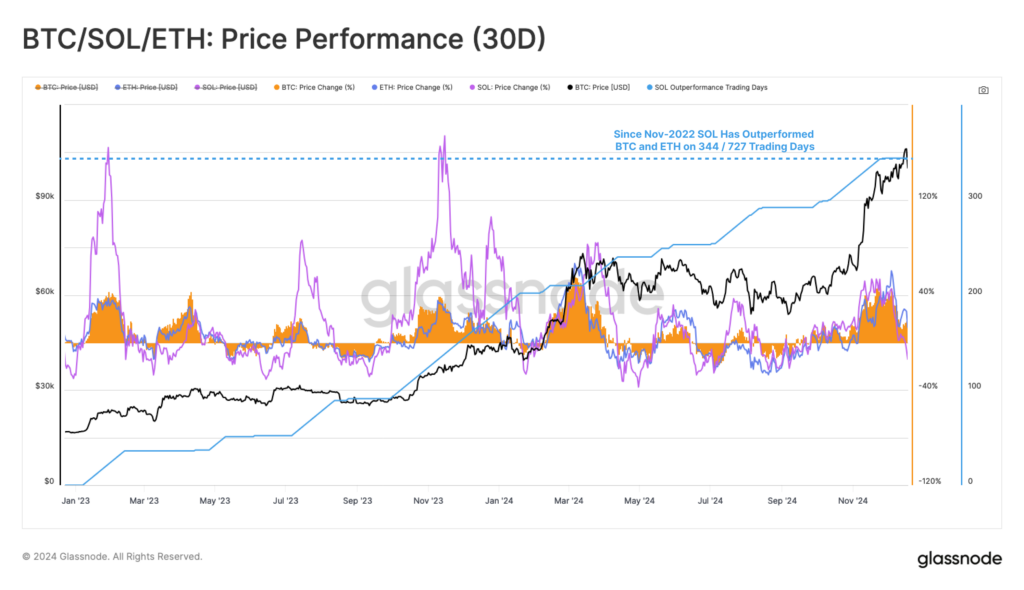

Glassnode emphasizes that Solana has been an excellent investment. With a price increase of more than 2,143% since the lows in November 2022, Solana has outperformed both Bitcoin and Ethereum on 344 of the 727 market days since the FTX collapse, indicating strong demand and interest in the market.

At the time of writing, Solana is trading around $194.58, representing a minimal drop of 0.50% in the last 24 hours. However, the trading volume has increased by 18.94% to $9.94 billion, indicating ongoing trading activity and interest in the token.

Despite the recent price correction, the long-term outlook for Solana remains positive, supported by solid market indicators and growing investor interest.