During the week of the US presidential elections, Polymarket soared to the top of popularity, but for many, this platform is a risky playground. With 89% of participants losing money, it shows the grim reality of betting on political outcomes.

Polymarket has gained attention due to the massive profits that can be made, such as the $47 million earned by player Freddi9999 by betting on a Donald Trump victory. However, such profits often require ‘whales’, or large investors, to bet millions. But these financial high flyers also come at a price: the majority of players ended up on the losing side.

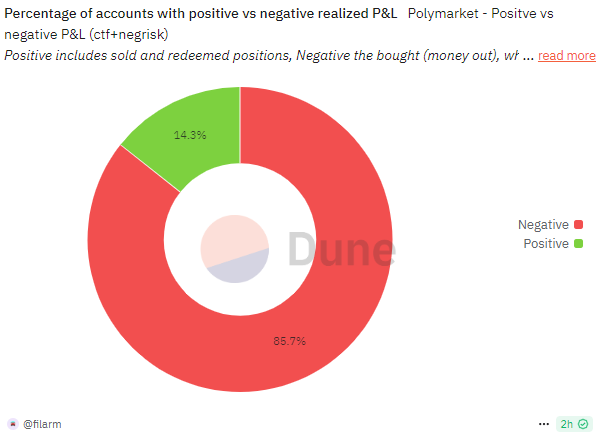

After the election results were announced, 14.3% of Polymarket users were in profit, while 85.7% suffered losses. However, the dynamics of the bets continued to change, with some whales holding their positions in hopes of a favorable outcome.

Each market on Polymarket has its own user profile. The most popular pair of the winner of the US elections showed that large-scale whales bet on Trump’s ‘yes’ token. On the other side of the bet, there were a greater number of positions, but these mainly came from smaller wallets.

The majority of bets on Polymarket come from wallets with less than $100 in trading volume. However, nearly 8,500 wallets have volumes above $50,000, including some whales entering the largest available positions. Over 100,000 wallets limit their participation to 1-5 bets, with another 95,000 wallets making around 20-50 transactions. The smallest elite group wallets average over 50 transactions.

Using multiple wallets is not uncommon, as players try to take positions without causing excessive price changes. In that scenario, a single whale could influence a betting market, leading to more volatility as bets normalize.

Now that Trump has won the elections, Polymarket is focusing on new bets related to his presidency, such as policies, cabinet positions, and even social media influencers. This shows that Polymarket has expanded from purely political to more diverse bets.

However, there is speculation that Polymarket’s liquidity after the elections could shift to other crypto assets. Max Kordek of Lisk suggests that liquidity could flow back to Ethereum. Nonetheless, the USDC tokens on Polymarket must either be moved to another ecosystem or stay within the Polygon ecosystem for further trading.

After the election highlights, where over $371 million in volumes went through the platform, the volume drastically decreased. Polymarket now needs to find a way to restore its trading volume and maintain its popularity in the market.