Bitcoin (BTC) is currently trading at $86,930, a three-month low that has the market in a bearish grip. As the total crypto market loses nearly $2 billion in value, Bitcoin whales are showing signs of opportunism with a transfer of 26,430 BTC to accumulation addresses. What’s driving these movements, and where is BTC headed? Let’s analyze the data and trends.

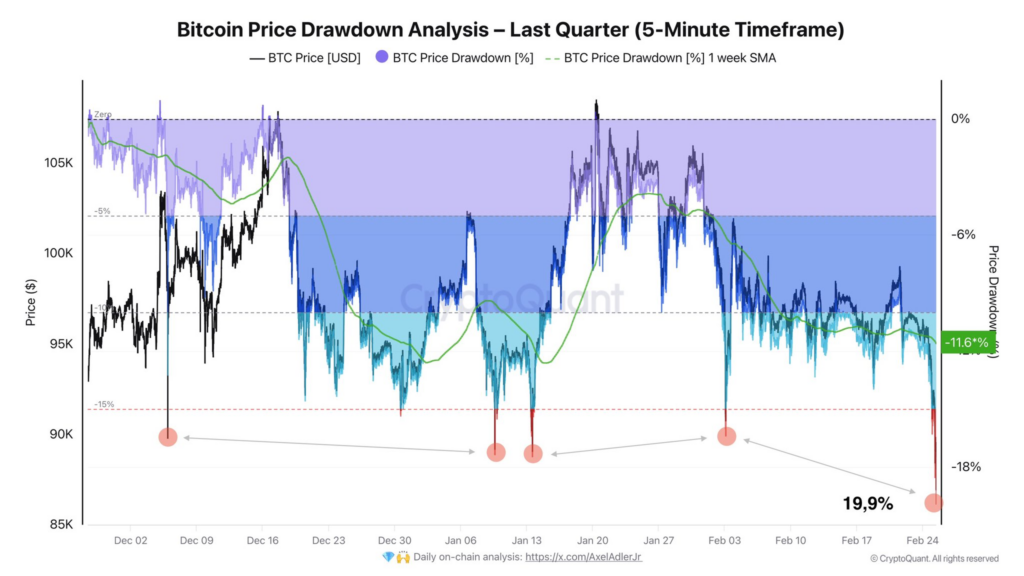

Bitcoin researcher Axel Adler Jr. reports that BTC’s weekly drop of 10% marks the largest quarterly correction since August 2024, with a drop of 20% – twice as sharp as the annual average of 8.9%. This sharp decline hits short-term holders (STH) hard: addresses with BTC younger than 155 days lost 27,500 BTC at a loss in the past 24 hours, a sign of capitulation.

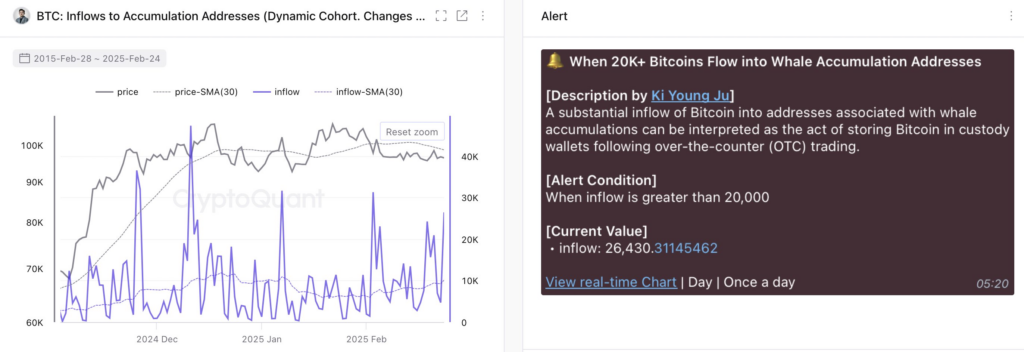

But amid this chaos, the whales are moving. CryptoQuant data reveals that on February 24, 26,430 BTC ($2.3 billion) was moved to known accumulation addresses, often linked to OTC deals and long-term storage. This follows Strategy’s previously reported purchase of 20,356 BTC for $1.99 billion. Whales seem to be taking advantage of the dip, in contrast to the panic among STH’s.

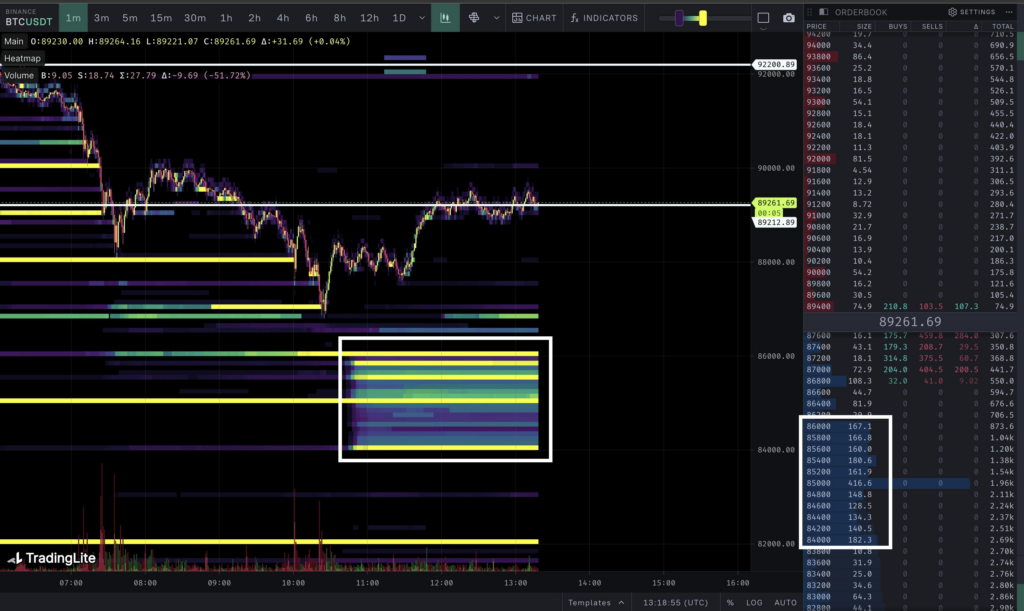

BTC’s daily candle closed on February 24 below $92,000, confirming a double top pattern that has been forming for months. This pattern technically predicts a drop of 16% from the neckline, with a target around $78,000-$76,000. The current price of $86,930 is approaching a liquidity gap of $81,700-$85,100, established on November 11, 2024, and still unfilled. Trader CRG reported on X a cluster of spot bids on Binance around $84,000-$86,000, indicating strong buying interest in this zone.

If $81,000 holds, a “dead cat bounce” may follow. If BTC breaks below, the CME gap of $77,000-$80,000 remains as the last support – a level that would complete the double top target.

The market is suffering from a combination of factors: five days of net outflows from Bitcoin ETFs ($571 million this week), Trump’s tariffs on Canada and Mexico, and a rising BTC supply on exchanges due to whale dumping. However, the accumulation of 26,430 BTC offers a counterbalance, hinting at confidence among long-term investors.

Bitcoin’s 20% quarterly drop and whale activity paint a negative picture for the market. Support between $81,000-$85,000 is crucial – if it holds, a recovery to $90,000+ may follow; if not, $77,000 is threatened.