Curve DAO is the governance token of the Curve Finance platform, a leading DeFi protocol that focuses on the efficient trading of stablecoins and liquidity provision. Curve is known for its unique algorithm that minimizes slippage, making it attractive for large traders and institutional parties. Additionally, Curve plays a significant role in the broader DeFi ecosystem by optimizing liquidity sources and deploying veTokenomics (such as veCRV) to reward user loyalty. It is one of the fundamentally strongest DeFi projects, making it a favorite among investors and whales.

After an impressive rally of over five hundred percent from the lows, CRV has recently made a pullback. Interestingly, this pullback has occurred to the golden pocket, i.e., the area between the 0.618 and 0.65 Fibonacci retracement. This is an important level where demand often arises, as it serves as a support point after an upward movement. The price reaction we see here indicates possible bullish continuation.

Based on the Elliott Wave analysis, Curve DAO appears to have completed the wave 2 phase, with the golden pocket serving as a crucial level. We may be on the eve of wave 3, the strongest impulse movement in the cycle.

In previous cycles, we saw that ADA also completed its wave 2 in the golden pocket and then began an explosive wave 3. Curve DAO shows striking similarities, making this scenario extra credible.

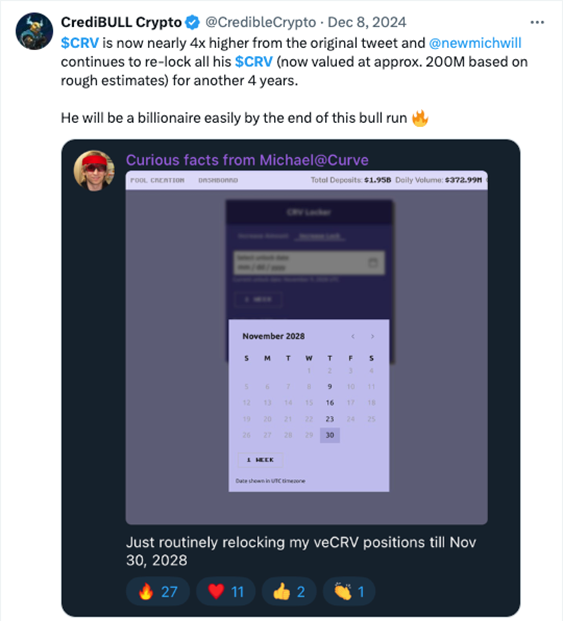

A notable bullish signal is the news that Michael Egorov, the founder of Curve, recently staked more than 200 million CRV again until November 2028. This suggests enormous confidence in the future of Curve Finance and creates a unique situation in the market.

The technical setup combined with fundamental strength makes CRV an attractive choice. The recent pullback to the golden pocket and the bullish reaction to it, along with the founder’s commitment, provide a solid basis for a next rally.

With the strong fundamentals of Curve DAO and the technical setup, the current phase seems more of a stepping stone to new highs than an endpoint of the rally. The CRV token appears to continue to play a key role in the broader DeFi ecosystem, and the risk-reward ratio is particularly attractive for investors who understand the cycles.

Disclaimer: Historical performances offer no guarantee for the future, and corrections are always possible. Nevertheless, CRV appears to be in a healthy position to grow further.

Disclaimer: The analyses above are based on technical patterns and trends in the crypto market. It is crucial to emphasize that this information is not intended as financial advice. Cryptocurrency investments inherently carry risks and are subject to volatility. For investment decisions, it is recommended to do your research, seek financial advice, and only invest what you can afford to lose.