Bitcoin (BTC) is experiencing a wild ride. After a brief surge to $95,000, the price fell back to a low of $82,000, now fluctuating around $88,908. According to Glassnode, BTC is stuck in a distribution phase, with doubled volatility and few accumulation opportunities. What’s happening, and where is this going?

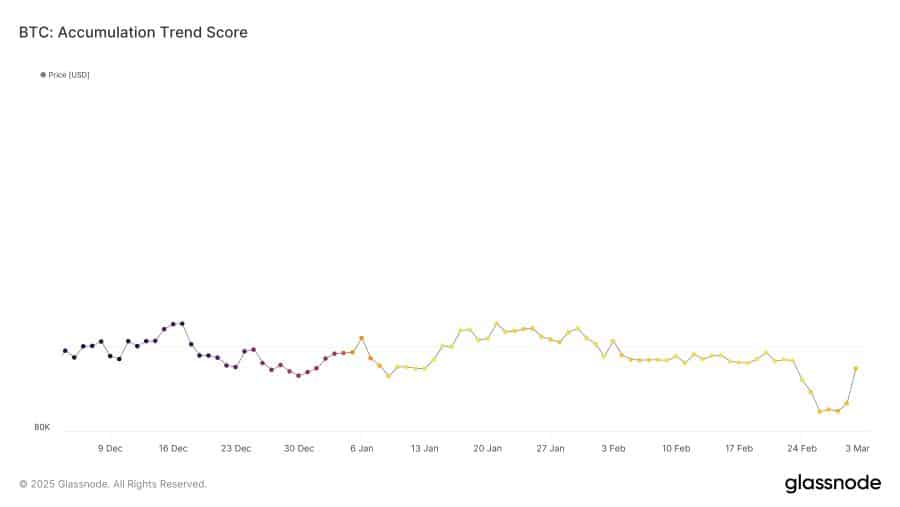

Glassnode’s Accumulation Trend Score tells a gloomy story: for 58 days it has been below 0.5, indicating net distribution – holders are selling more than they are buying. This is approaching the average duration of a distribution phase (65 days), compared to 57 days for accumulation in the past year. In total, 2024 saw 170 days of accumulation (>0.5) and 196 days of distribution (<0.5), with a cycle change every 57-65 days. But the current score of 0.9 shows that major players – whales – are still dumping heavily, with no signs of a turnaround.

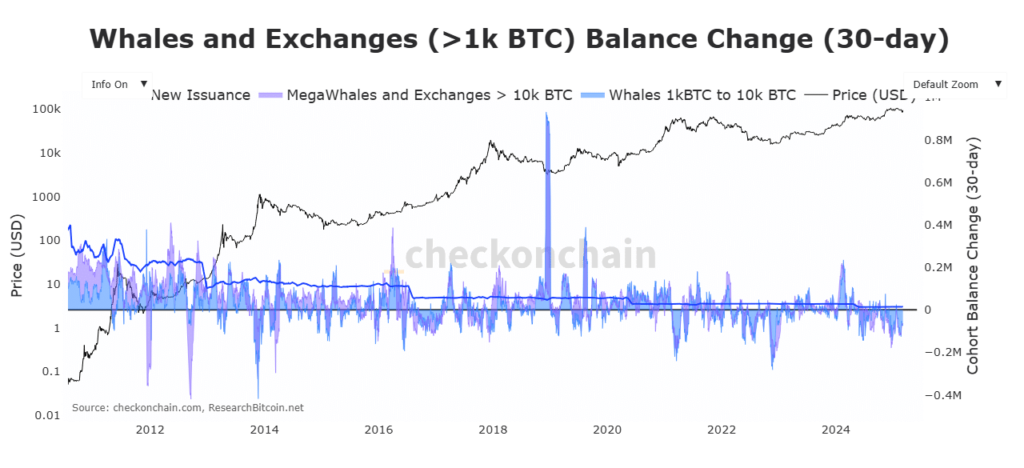

Whale activity confirms this. The balance on exchanges shot from -75.8K to +12.9K BTC: more deposits than withdrawals, a clear sell signal. This, plus a negative cumulative volume difference, underscores the selling pressure. “Bitcoin is still in distribution,” reports Glassnode. As long as whales continue to offload, recovery is delayed.

Volatility exploded due to external factors. Trump’s Crypto Strategic Reserve announcement on March 2 drove BTC from $85,000 to $95,000, but his 25% tariffs on Canada and Mexico (March 4) wiped out those gains. Macro uncertainty – trade war fears, a falling S&P 500 (-2%) – strangles risky assets. Speculative demand disappears, and addresses sell as soon as the hype stops, prolonging the distribution.

Without accumulation, the price remains weak. Glassnode sees $82,500 as a possible next low point if sentiment does not turn. The $1 billion in liquidations yesterday (87% longs) shows how overconfident traders were caught. Bulls hope for a shift, but whales and macro pressure keep the reins tight.

Recovery depends on two things: decreasing macro concerns (tariffs, Fed rates) and a return of organic demand. The White House Crypto Summit on March 7 could be a trigger, especially if Trump’s reserve becomes concrete. Until then? “No signs of accumulation,” warns Glassnode. BTC can go lower, unless investors dare to buy again.