At the tail end of 2024, Bitcoin (BTC) has seen a remarkable price increase, fueled by Binance’s massive stablecoin reserves and a positive market dynamic. On December 31, these reserves reached an impressive $44.5 billion, representing a huge purchasing power that seems ready to push Bitcoin to new heights.

At the time of writing, Bitcoin is trading at around $94,000, an increase of 1.20% in just 24 hours. This mix of liquidity and momentum leads us to suspect that the future for the crypto market looks promising.

Stablecoins are a direct source of liquidity in the crypto world and often act as the engine behind Bitcoin price increases. Historically, we have seen that a significant influx of stablecoins to exchanges leads to BTC rallies by stimulating demand. Take, for example, the rally on December 11; an increase in stablecoin activity helped Bitcoin rise by 4.7% in one day. The current reserves suggest that we may be on the verge of a new rally, further fueling optimism among investors.

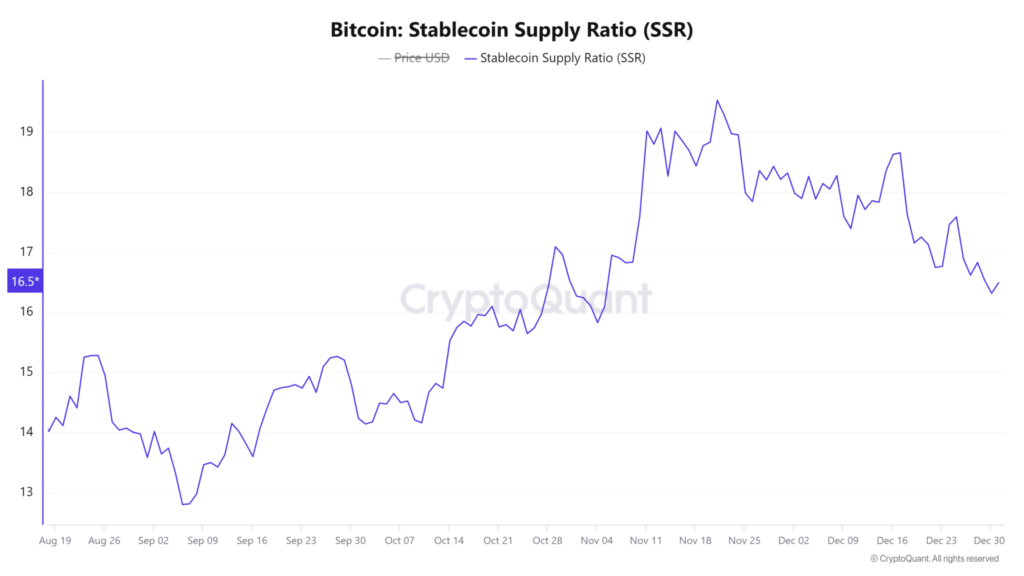

The Stablecoin Supply Ratio (SSR) is a key indicator reflecting Bitcoin’s growth potential. At the moment, the SSR stands at 16.55, with a daily increase of 1.01%, indicating sufficient liquidity relative to Bitcoin’s market capitalization. This creates a favorable climate for a Bitcoin price increase, as there are enough stablecoins available to support demand. The SSR trends thus strongly support the possibility of continued upward momentum.

Bitcoin has recovered from the support at $92,198.11 and is moving towards a possible breakout from a falling wedge. Such patterns have historically announced a bullish reversal, and Bitcoin’s current movement points to a similar scenario. A key resistance at $100,310.79 could pave the way for a target of $110,000 in the medium term. BTC’s price action strongly suggests that the current upward trend will continue.

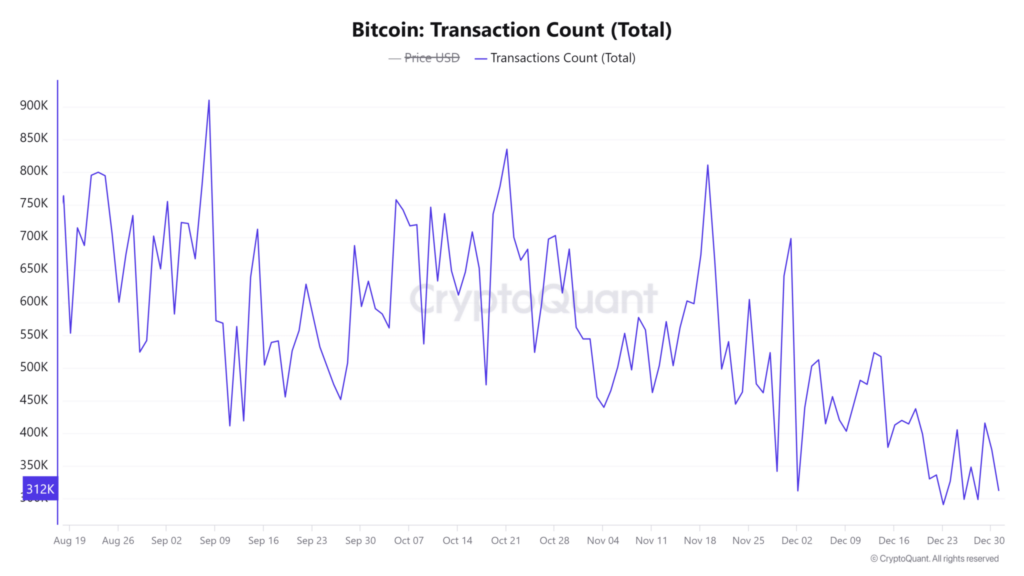

The transaction numbers show steady activity with 312,056 transactions at the time of writing, an increase of 0.92% in 24 hours. This indicates increased engagement with the Bitcoin network, which often occurs when investors are actively accumulating. The stable transaction volume supports the positive sentiment and suggests robust market involvement in the future.

Technical analysis highlights BTC’s bullish potential. The Stochastic RSI is oversold with a value of 10.69, indicating an imminent upward reversal. Moreover, the 9-day moving average (MA) at $95,123.93 is above the 21-day MA at $98,020.56, indicating strong buying momentum. These signals together predict a continuation of the Bitcoin rally.

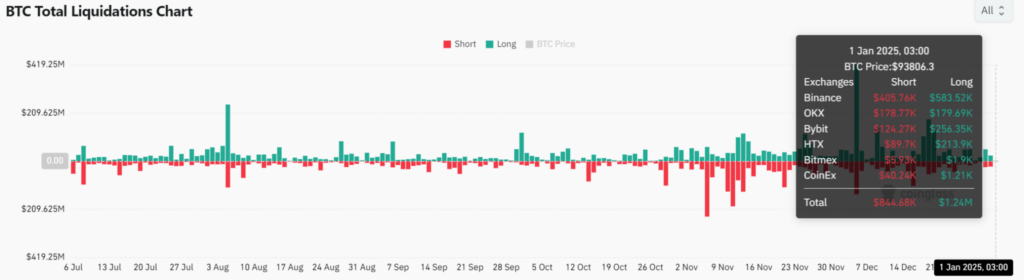

Liquidation data shows a predominantly optimistic sentiment, with $1.24 million in long positions being liquidated versus $844,000 in short positions. This imbalance highlights strong buying pressure and confirms the market’s confidence in BTC’s upward trend. It suggests that the optimistic momentum is likely to continue in the short term.

With Binance’s stablecoin reserves at $44.5 billion, there is immense liquidity available that strongly supports the current Bitcoin rally. Combined with technical and transaction trends, investors can confidently look forward to a possible price of $110,000 for Bitcoin in the medium term.